Cold Chain Monitoring: Transporting Perishables Around the Globe

- Blog

- IoT Trends

- Cold Chain Monitoring: Transporting Perishables Around the Globe

Peter Kuijt, VP of Sales Europe, explains why ORBCOMM’s end-to-end solutions for two-way wireless cold chain monitoring is leading the way globally.

1. When transporting perishable goods such as fresh fruit and vegetables what are the typical challenges faced in ensuring the goods are delivered on time and in the correct condition?

Maintaining the correct temperature on the cold chain journey from origin to destination is by far and away the biggest factor influencing the final delivery quality and shelf life of fresh fruits and vegetables. First and foremost, success is all about temperature, temperature – and temperature. This is especially the case for fresh fruit and vegetables, but it’s very important likewise for chilled foods such as dairy, confectionary, prepared meals and fresh protein, and for frozen seafood. Deep-frozen staples like chicken, pork, beef and vegetables also still need proper temperature management.

Trade in food has become increasingly international in recent years, which has created new markets for producers from around the world, new business for the logistics, shipping and transport industries and new experiences for consumers. But the length and complexity of transport operations across land, sea and air pose significant challenges for timely, quality delivery of cross-border and intercontinental shipments.

The multiple ‘hand-offs’ between different parties along the chain from producer to point of sale, and from mode to mode, all present a risk of breaking the cold chain and compromising the cargo. Take for instance a refrigerated container unloaded from a vessel that does not get plugged into power at port in the required timeframe. Or a cross-dock operation where goods being transferred from a refrigerated sea container into a reefer trailer are exposed to ambient temperatures for too long during unload/load. These are just a few examples of where things can and do go wrong, aside from the perennial challenges of reefer equipment malfunction or failure.

World trade in perishables continues to grow at around 4% annually, with significant demand growth from China, other Asian nations and Africa. This is good news, but in many cases cold chain infrastructure, skills and coordination are still lacking in these important growth markets.

Both in mature and emerging markets, Internet of Things (IoT) technology has a critical role to play in addressing cold chain challenges by providing real-time visibility into shipment status, including location, temperature and other conditions, and in many cases allowing temperatures to be adjusted remotely. Status information can be remotely viewed in the cloud, allowing informed decisions to be made and early action to be taken when potential issues are detected. Information can also be shared with different supply chain members on a single platform.

2. Are there any major differences in the technology used by ORBCOMM across Road, Rail and Sea routes within the cool chain supply chain?

Yes, and no. The essentials are the same: an IoT ‘stack’ that includes telematics tracking devices and sensors, data connectivity via GSM and satellite, and SaaS cloud and mobile applications to view and respond to information on all types of assets as they travel on road, rail and sea. ORBCOMM has a wide variety of telematics devices and IoT sensors to meet the needs of different cold chain transport assets and operations, from units that are integrated with the controller of a refrigerated container to multi-zone temperature sensing devices for refrigerated trailers to HACCP (food) and GAMP-5 (pharma) compliant temperature monitoring recorders and printers.

We also have temporary tracking devices that can be used with a variety of transport assets versus a more permanent solution. Door and cargo sensors, security cables and fuel monitoring can also be integrated for additional visibility of cargo status, improved efficiencies and added security.

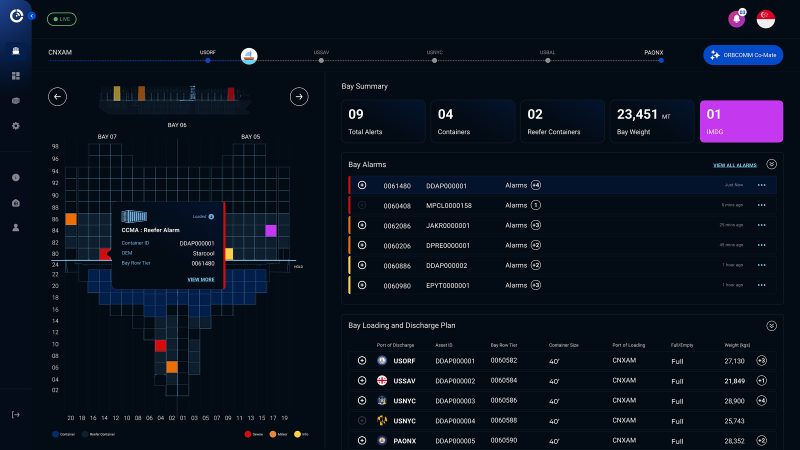

When it comes to sea routes, the first requirement is to have a smart asset – an intermodal container or trailer that is equipped with a cold chain telematics device. To cost-effectively capture data from these devices while out at sea beyond the reach of terrestrial networks, vessels need their own GSM network capability. That’s why we launched our VesselConnect solution in 2017, which provides a viable way for shipping companies to set up a GSM ‘bubble’ to monitor smart containers and trailers while they are on-board. The system allows crew to view refrigerated equipment status safely on a ship-board PC rather than having to manually inspect units in potentially hazardous conditions, and information can also be sent back via satellite to a remote base onshore.

3. When monitoring the temperature of perishable goods how regular are the updates to the cargo owner?

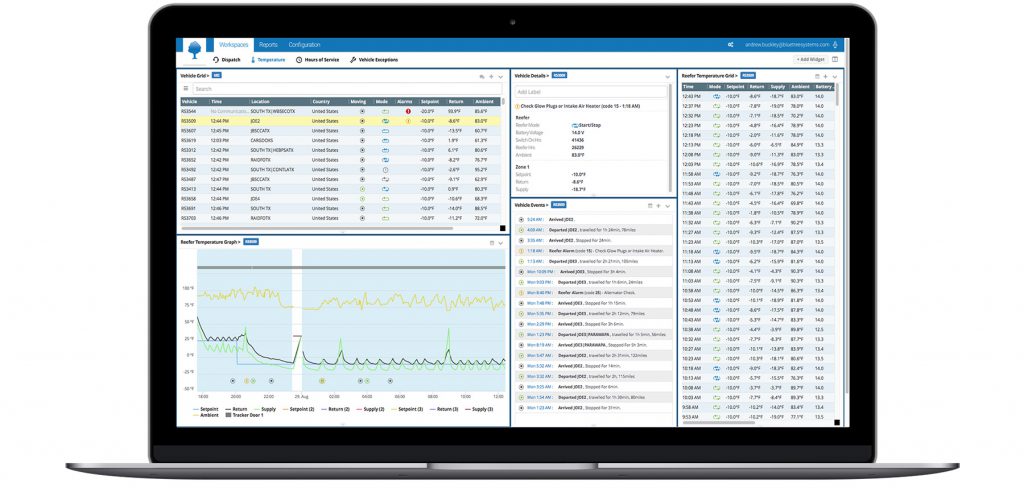

There are two questions here – how regular are updates and what does the cargo owner see? To the first, data from reefer containers, trailers and other cold chain assets is fed to the cloud in near real-time so there are updates at least every 15 minutes when devices have data connectivity. The volume of raw data reported is huge and a key job is to ensure users are not flooded with meaningless information. Our software plays a crucial filtering role, so users receive usable updates on their cloud and mobile dashboards, not least automated alerts and alarms. Of course, users can also download complete trip temperature logs for compliance and other purposes.

With regards to frequency of cargo owner updates – it depends on who owns the tracking technology and how they choose to share data with their ecosystem. Maersk Line and TOTE Maritime, for instance, are examples of a global and regional carrier respectively who have chosen to give cargo owners free access to data from their smart reefer containers and trailers, which use ORBCOMM technology. Other ocean and land carriers are now doing the same. In some cases, it is cargo owners themselves who acquire the technology, either because they own their own containers or on a ‘trip’ basis, in which case they can specify their requirements.

Increasingly, we see the future revolving around integrated cloud data platforms such as ORBCOMM provides, where many different types of cold chain equipment can be monitored, and many cold chain parties can access the same information, for a ‘single source of the truth’.

4. How do your solutions help improve compliance with regulatory standards?

IoT solutions fulfil multiple goals. Compliance is a crucial one, as regulatory requirements become more stringent both for food and pharma safety and traceability. As an example, in North America, our solutions help operators comply with the Food Safety and Modernisation Act (FSMA) – possibly the largest ever piece of food safety legislation worldwide – by delivering continuous monitoring of refrigerated transport assets as they travel to their destination.

Because the tracking device connects directly to the refrigerated transport unit’s computer, it can detect sudden temperature changes and deliver real-time alerts to the appropriate contacts before a load is compromised or lost. It can detect if the temperature of a trailer is adequate for the type of load is carrying, and notify the operator when this is not the case. Two-way control of the asset enables transporters to remotely adjust a reefer’s set temperature, initiate a pre-trip inspection or a pre-cool sequence, without engaging the driver’s help. for compliance, the system also automatically collects and stores temperature records, making it possible for the operator to provide proof-of-temperature records on demand.

Because the tracking device connects directly to the refrigerated transport unit’s computer, it can detect sudden temperature changes and deliver real-time alerts to the appropriate contacts before a load is compromised or lost. It can detect if the temperature of a trailer is adequate for the type of load is carrying, and notify the operator when this is not the case. Two-way control of the asset enables transporters to remotely adjust a reefer’s set temperature, initiate a pre-trip inspection or a pre-cool sequence, without engaging the driver’s help. for compliance, the system also automatically collects and stores temperature records, making it possible for the operator to provide proof-of-temperature records on demand.

We have a similar situation in Europe, where our Euroscan devices are HACCP certified for food safety compliance and GAMP-5 certified for capturing compliance data related to the Good Distribution Practice (GDP) rules for pharmaceutical distribution.

5. From a technology standpoint how much more challenging is the cool chain sector when compared to intermodal container tracking for example?

Refrigerated containers are in fact the main type of intermodal container that is being tracked today because the business case is strong in terms of reduced cargo damage and claims, and lower maintenance and inspection costs. But refrigerated containers, trailers and other cool chain applications are of course among the most demanding, involving the integration of telematics technology with the electronic ‘brains’ of transport refrigeration units and/or use of sensors inside trucks, trailers and containers, so as to monitor and remotely adjust temperatures and other climate conditions. This is more advanced than basic tracking of dry container or trailer equipment, though even for dry cargo transport we are providing a growing range of sensor technology on top of basic location services, to enhance security and productivity.

ORBCOMM’s FleetManager SaaS cloud platform

6. Are there any major differences between the technology used to monitor the temperature of perishable food cargo when compared to pharma solutions?

The technology principles are the same, however, compliance requirements do differ. As an example, we were the first cold chain transport technology company to be certified to the demanding GAMP-5 European standard for pharmaceutical data. GAMP-5 certification verifies that computerised systems are compliant in terms of data quality and integrity. This means that data reported from our telematics devices and cloud platform can be trusted for compliance with the EU Good Distribution Practice (GDP) rules for pharmaceuticals.

7. How do you see the industry developing and what challenges do you expect to face in regard to product development within the cool chain sector?

Real-time connectivity, visibility and traceability into what’s happening as perishable goods of all kinds move along the cold chain will be increasingly expected to meet cargo owner, regulator and consumer expectations, and to help carriers and logistics providers run their operations more effectively. Some 80% of refrigerated trailers in the USA, for instance, are already equipped with ORBCOMM telematics to report location and temperature conditions.

Real-time connectivity, visibility and traceability into what’s happening as perishable goods of all kinds move along the cold chain will be increasingly expected to meet cargo owner, regulator and consumer expectations, and to help carriers and logistics providers run their operations more effectively. Some 80% of refrigerated trailers in the USA, for instance, are already equipped with ORBCOMM telematics to report location and temperature conditions.

IoT technology is creating a new generation of intelligent cool chain assets that will provide essential data for the new sharing economy. There is a lot of work to do at industry and government level, of course, to manage this huge transition and a key challenge will be to create the new regulatory framework that will support companies to make technology investments. Still, we see cool chain as one of the most engaged and exciting markets for IoT technology today and in the future. Especially, now we can capture all this information, the next phase will be to apply advanced analytics to the mass of data, both to drive daily operations and provide new business insights, efficiency and opportunities. This will certainly be one of our focus areas for 2018.

Originally published in International Trade Magazine

With over 15 years of marketing experience at companies big and small, Lina Paerez leads ORBCOMM’s global marketing team, driving key positioning strategies, product launches, demand generation and brand awareness.